Coming soon, a standard personal accident Insurance Policy,Should you buy?

After facilitating uniform health, COVID-19 and term policies, the Insurance Regulatory and Development Authority of India (IRDAI) has now proposed a standard personal accident policy.

Once the draft guidelines are finalised, all general and standalone health insurers will have to compulsorily offer this product from April 1, 2021.

The workings

Like any other personal accident or accidental death covers already being offered by non-life insurers, this standard, benefit-based product will hand out the full sum-assured in case the policyholder dies due to an accident. As the name suggests, the claim will be paid only if the death occurs due to accidents and not natural causes. The policy wordings define accidents as “sudden, unforeseen and involuntary events caused by external, visible and violent means.”

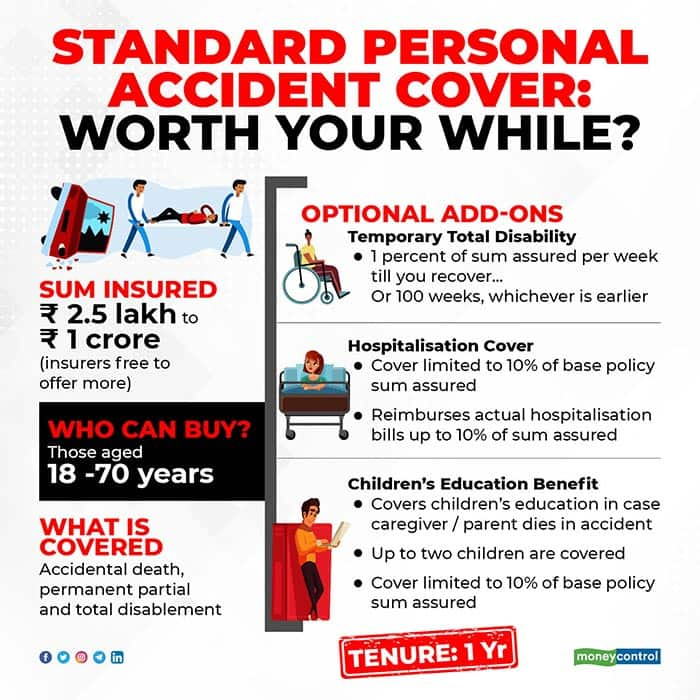

More importantly, however, a personal accident policy also compensates for any loss of income due to permanent total or partial disabilities caused by accidents. The standard personal accident product, which will come with a tenure of one year, will cover death and permanent partial or total disability under the base cover.

The entire sum-assured will be paid out in case of total and irrecoverable loss of both eyes, complete loss of hands and feet, besides loss of eyesight. In case of permanent partial disablement, on the other hand, part sum-assured will be paid, as per pre-defined sub-limits. For example, loss of use of one entire hand or foot or eye will entitle the policyholder to 50 percent of the sum-insured. If there is a loss of all toes, 20 percent of the sum-insured will be paid out.

The minimum sum insured under the proposed policy is Rs 2.5 lakh, while the maximum is Rs 1 crore. However, the insurance regulator has said that insurers can offer larger covers on their own. The premiums will be determined by insurers.

Optional add-on benefits

Temporary total disablement is covered under its optional cover – that is, add-on that you can buy after paying an extra premium. Under this cover, you will be entitled to compensation at the rate of one percent of the sum insured per week till you return to work or up to 100 weeks, whichever is earlier. Likewise, hospitalisation expenses, too, will be covered to the extent of actual expenses incurred by you, if you buy an optional add-on cover. However, these will be capped at 10 percent of the sum-insured. The third optional cover on offer is termed education grant. In the case of death or permanent disablement of the policyholder, the insurer will pay a one-time educational grant of 10 percent of the base sum insured for up to two dependent children, not older than 25 years. This payment will be made only if the child is pursuing a course as a full-time student in an educational institution.

While a personal accident policy is a fairly simple product when it comes to settling death claims, this is not the case as far as compensation for disabilities is concerned. Most features proposed in the standard personal accident policy are already being offered by non-life insurers with some variations. Laypersons are likely to find it difficult to grasp the intricacies of payouts under permanent total and partial disabilities, which could lead to heartburn at the time of claim settlement. The compensation caps on the type and extent of disablement, too, can be a source of disputes. For example, suppose a policyholder has not read the nitty-gritties in detail. She is not aware that in the case of loss of toes, the compensation paid will be 20 percent and not the entire sum assured. In such a case, she is bound to feel short-changed.

While these limitations are part of the standard cover as well, the fact that it has been devised by the regulator will offer comfort to policyholders. The probability of policyholders feeling short-changed by the insurer would be lower as they would know that the clauses are uniform across companies.

A personal accident policy is a must-have in your portfolio. Youngsters tend to put off life and health insurance purchases if they have no dependents or believe they are in perfect health, but the risk of accidents cannot be wished away. They will come in handy even if you have both life and health covers, as they offer compensation for income loss in case of disablement.